This article is part of the “Bitcoin 101”, a series of short articles that explain the why and how of bitcoin.

Perhaps the best understood aspect of Bitcoin: its scarcity. Indeed, the total supply available on the Bitcoin network is strictly limited to 21 million bitcoins (BTC), each divided into 100 million sub-units, called satoshis (sats). Technically, there will be neither more nor fewer bitcoins in circulation on the network. In reality, its supply is further reduced due to bitcoins lost in the past.

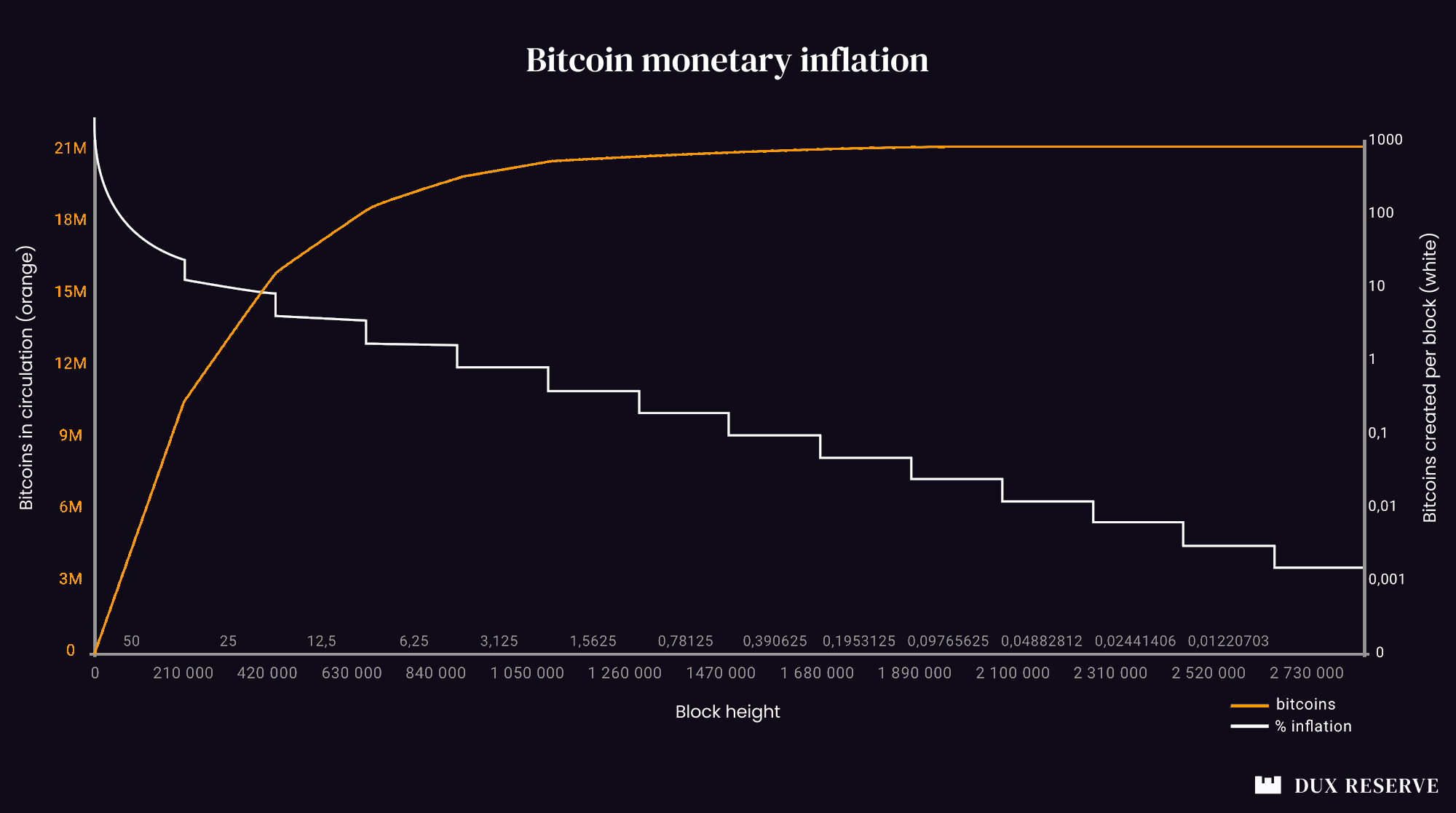

However, what is written in the protocol's computer code is not this limit of 21 million units, but a rate of creation of new bitcoins. When the network started on January 3, 2009, 50 BTC were created during the batch processing of transaction settlements, which is commonly called a “block”. The creation of a block takes on average 10 minutes.

Another rule of the protocol is added to these first two rules, and stipulates that every 210,000 blocks—which equates to approximately 4 years—the issuance of bitoins per block is halved. This division is called the “halving”, which simply means “to cut in half”. From 2009 to 2012, 50 BTC were created per block on average every 10 minutes. Between 2012 and 2016, this was therefore halved to 25 BTC. Between 2016 and 2020, it was 12.5 BTC per block and since 2020, it has again been reduced to 6.25 BTC. This reduction will continue until there is nothing left to divide, and is expected to occur in 2140, with a total of 21 million BTC created.

With these two very simple rules, the Bitcoin network cannot undergo unexpected inflation, as all network participants control their implementation. Bitcoin is therefore of an absolute rarity that no one can change.