The Europeans save

During the 2020 lockdowns, the French saved much more than usual, accumulating an additional 180 billion euro. Specifically, this represents an average of 276 € in savings per month for the French in 2020. There are several popular options for saving in France. The “Livret A”, life insurance, and the “Compte Épargne Logement” are well-known options in France. With the uncertainty associated with the current recession, we are increasingly setting money aside to protect ourselves from job loss or to make plans for the future. This is a good thing.

On the other hand, these savings options are limited in their main function: preserving their value over the years. Indeed, when one is 30 or even 50 years old, saving to finance a life project such as buying a house, their children's education, or retirement is no small task. Which savings account to choose? What are the expected returns? Should I be interested in real estate or the stock market? What about Bitcoin? It's difficult to answer these questions when working during the day. It's also not the most entertaining topic for everyday conversation. Yet, it's a question at the heart of our lives.

Traditional savings are losing purchasing power

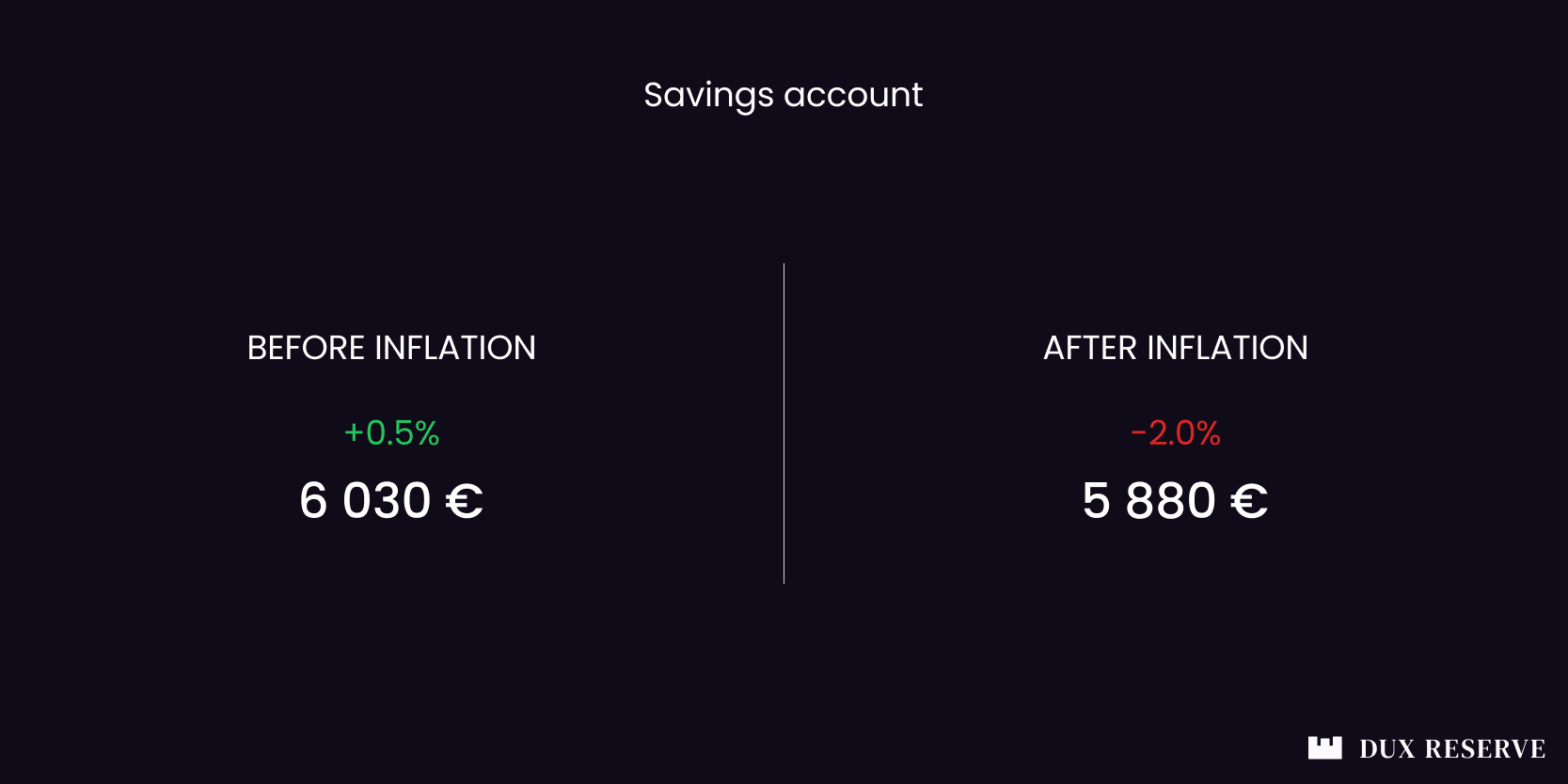

Let's take an example. Today, saving 500 € per month, or 6 000 € per year, in a Livret A (a type of French savings account) yields 0.5% in gross interest, which is 30 €. Inflation, which is measured by the general increase in prices, is expected to be around 2.5% in Europe in 2024. Far from being reliable, this measure is used to calculate the real return, which takes into account the loss of purchasing power due to inflation. For a Livret A, the return could be negative at around -2.0% by the end of the year. In other words, a net loss of purchasing power. The interest rates on traditional savings plans range from 0.5% to 1% with deposit limits. Therefore, saving in a traditional savings account may not be a very effective way to accumulate wealth for the future.

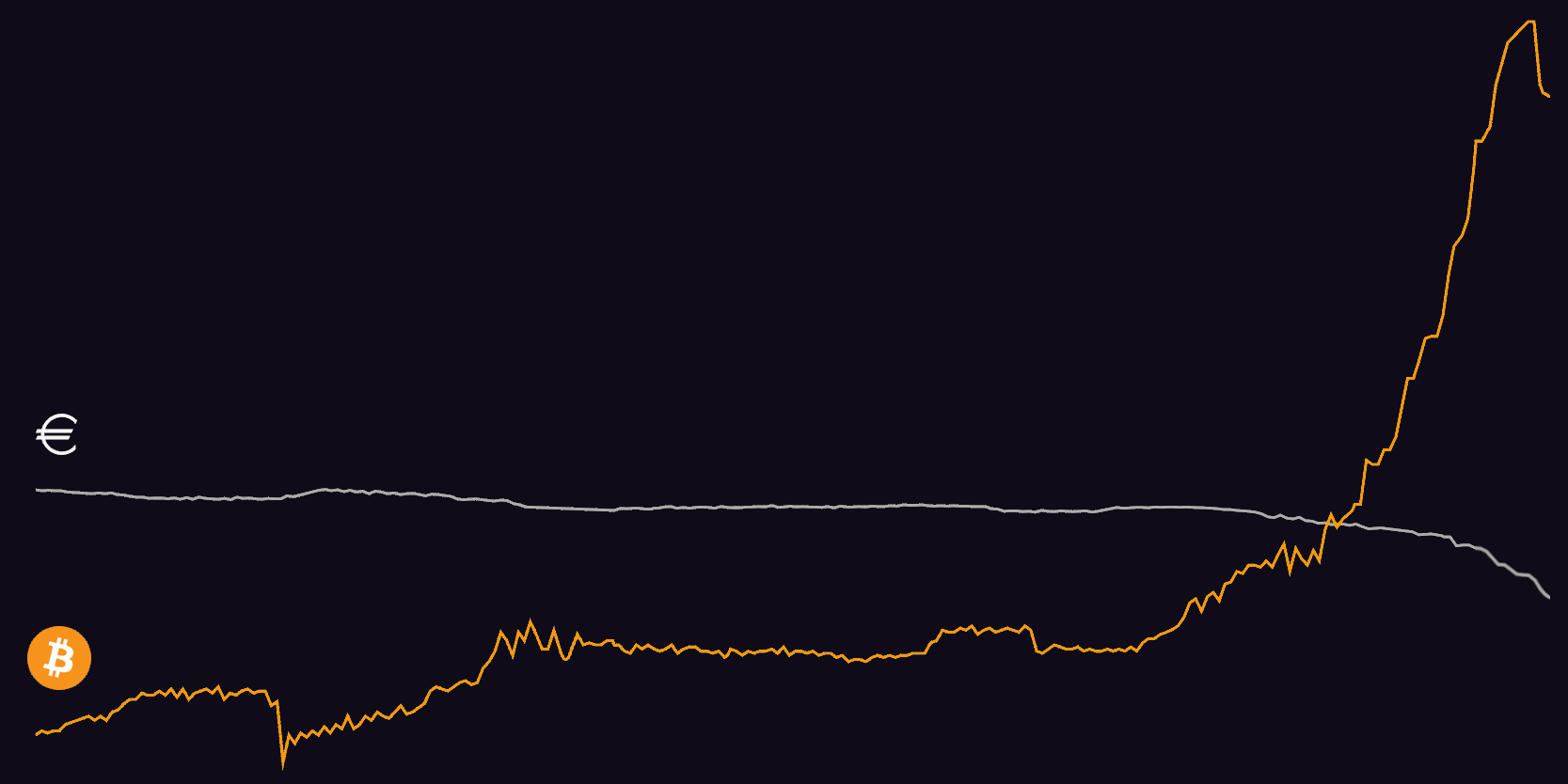

As for investments in the stock market and real estate, they are in the minority. We Europeans are very cautious savers, with a large portion of savings allocated to low-risk assets. The problem is that low-risk investments do not offer adequate protection against the loss of purchasing power of the euro. The recent increases in consumer prices in 2021 are related to the decrease in the purchasing power of the euro. An abundance of new euro was created to finance economic stimulus programs in Europe, which has simply devalued the euro in circulation, including those in our savings accounts today.

To explain this phenomenon without going into details, the European Central Bank, which is responsible for the circulation of euro, nearly doubled the quantity of euro in 2020 alone. This significant increase in the quantity of euro, known to few people outside the world of finance, has resulted in the devaluation of the euro. Indeed, having 1 000 € in savings out of a total of 4 000 billion euro in circulation does not have the same value as having the same 1 000 € in savings out of 8 000 billion euro. That's the situation we find ourselves in today. Our euro are being diluted, and the prices of consumer goods, as well as the values of other investments like real estate, are rising in the face of our diluted euro. This situation is comparable to adding water to a bottle of wine to increase the quantity of a fine vintage, which degrades its quality.

And what if there was another savings option for Europeans? A plan B to protect themselves from inflation without necessarily becoming a seasoned trader in the stock markets or a real estate magnate?

Bitcoin, the new savings account of Europeans?

Bitcoin is known to everyone for its rapid price surges and historic crashes, like the one in 2020 with a 40% drop in a single day. This volatility is unsettling and gives rise to all sorts of accusatory narratives surrounding the cryptocurrency.

“Bitcoin has no value”

“Bitcoin is manipulated”

“Bitcoin is not stable enough to be a currency”

It is true that the price of Bitcoin fluctuates with significant swings, making it a highly risky investment in a short-term perspective, meaning over just a few months. Moreover, Bitcoin is not backed by any company, state, or commodity. Bitcoin is also not regulated as legal tender in Europe, and it does not offer returns like those guaranteed by the governments in the savings accounts mentioned earlier. Nevertheless, Bitcoin positions itself as an intriguing long-term savings plan in a broader perspective.

Without providing a full explanation of the reasoning behind Bitcoin, it is about understanding it as a new emerging currency.

Yesterday, Bitcoin was only used as a speculative asset because it was highly volatile and unfamiliar. Today, millions of people around the world use it as a savings account by regularly acquiring it. Tomorrow, it could be used as a common currency and means of payment everywhere in Europe (El Salvador recognized Bitcoin as legal tender on September 7, 2021).

The scarcity of Bitcoin and its limit of 21 million units available, each divisible into 100 million subunits called “satoshis” or “sats”, make it a quality long-term investment. No central bank can change the supply limit available and therefore dilute the savers who acquire it. Bitcoin is thus an effective means of protecting one's savings against a loss of purchasing power. Its scarcity profile even makes it a high-performance long-term investment, with an average annual appreciation of over 150% in the last 12 years. Future performances are neither guaranteed nor predictable, but it is likely that the price of Bitcoin will continue to appreciate in the years to come. Some predict a price beyond 100 000 euro, while others talk about 1 million euro or even 100 million euro for a single bitcoin. These predictions, which sometimes seem illusory, make us all dreams but, for now, they are solely opinions. Only time will tell if these expectations are consistent. One thing is certain, Bitcoin cannot fall to 0 euro because there are now millions of people buying it daily.

Regular and programmed accumulation (DCA) is now the best way to acquire Bitcoin without worries. Trying to find the right time to buy it is a futile effort for the majority of people. This can cause a lot of stress and waste a lot of time and money for those who try to speculate on its price fluctuations. Savings, therefore, are the best way to use Bitcoin today. The long-term appreciation potential remains high, so it is less interesting to use it as a means of payment. Moreover, Bitcoin is often associated with digital gold, a new safe haven in a digitalized world.

For Europeans, Bitcoin is primarily suitable for diversifying savings, in order to offset the loss of purchasing power of our traditional savings accounts. Due to its nature, a saver can fully own bitcoins by taking possession of their keys. Therefore, there is no direct dependency between a bank and a Bitcoin savings account. This topic, although essential in understanding Bitcoin, is reserved for a future article.

If you have understood the benefits of saving not in euro, but in bitcoins, you have understood who and why we are doing Dux. We help Europeans secure their future and that of their families. We can assist you step by step towards a secure and lasting Bitcoin savings account.